Introduction

You may be able to get a payment to help with the cost of living if you’re getting certain benefits or tax credits. You do not need to apply. You’ll be paid automatically.

The advice in this article applies to England and Wales only.

If you have had a message asking you to apply or contact someone about the payment, this might be a scam.

If you’re eligible, you’ll be paid automatically in the same way you usually get your benefit or tax credits. This includes if you’re found to be eligible for a Cost of Living Payment or a Disability Cost of Living Payment at a later date.

You could get up to 3 different types of payment depending on your circumstances on a particular date or during a particular period:

- a Cost of Living Payment, if you get a qualifying low income benefit or tax credits

- a Disability Cost of Living Payment, if you get a qualifying disability benefit

- a Pensioner Cost of Living Payment, if you’re entitled to a Winter Fuel Payment for winter 2022 to 2023

These payments are not taxable and will not affect the benefits or tax credits you get.

Low income benefits and tax credits

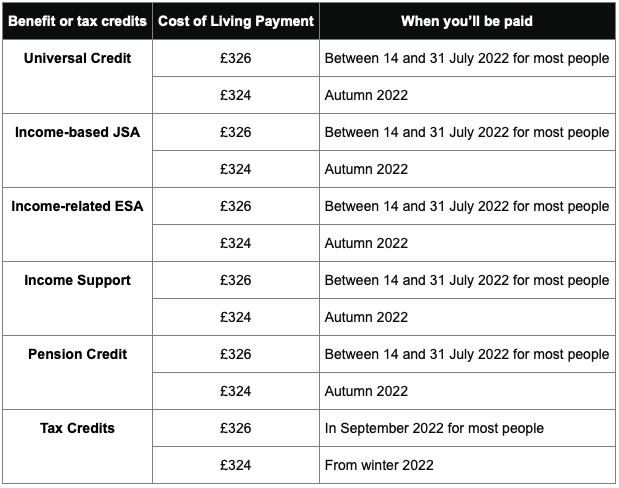

You may get a payment of £650 paid in 2 lump sums of £326 and £324 if you get payments of any of the following:

- Universal Credit

- Income-based Jobseeker’s Allowance (JSA)

- Income-related Employment and Support Allowance (ESA)

- Income Support

- Pension Credit

- Child Tax Credit

- Working Tax Credit

You will not get a payment if you get New Style Employment and Support Allowance, contributory Employment and Support Allowance, or New Style Jobseeker’s Allowance, unless you get Universal Credit.

If you have a joint claim with a partner, you will get one payment of £326 and one payment of £324 for your joint claim, if you’re entitled.

Universal Credit

To get the first Cost of Living Payment of £326, you must have been entitled to a payment (or later found to be entitled to a payment) of Universal Credit for an assessment period that ended in the period 26 April 2022 to 25 May 2022.

We will update this guidance when the government has announced the qualifying dates to get the second payment of £324.

The payment will be made separately from your benefit.

Universal Credit ‘nil awards’

You will not be eligible for the Cost of Living Payment if your earnings reduced your Universal Credit to £0 for the qualifying assessment period. This is sometimes called a ‘nil award’. If money has also been taken off for other reasons (such as payments of rent to your landlord or for money that you owe), you might still be eligible.

Income-based JSA, income-based ESA, Income Support and Pension Credit

To get the first Cost of Living Payment of £326, you must have been entitled to a payment (or later found to be entitled to a payment) of income-based JSA, income-related ESA, Income Support or Pension Credit for any day in the period 26 April 2022 to 25 May 2022.

We will update this guidance when the government has announced the qualifying dates to get the second payment of £324.

The payment will be made separately from your benefit.

Tax credits

To get the first Cost of Living Payment of £326, you must have been entitled, or later found to be entitled, for any day in the period 26 April 2022 to 25 May 2022 to:

- a payment of tax credits

- an annual award of at least £26 of tax credits

We will update this guidance when the government has announced the qualifying dates to get the second payment of £324.

If you get both Child Tax Credit and Working Tax Credit, you will receive a Cost of Living Payment for Child Tax Credit only.

If you get tax credits from HMRC and a low income benefit from DWP, you will get a Cost of Living Payment from DWP only.

When you'll be paid

If you had a joint claim between 26 April and 25 May 2022, a single payment of £326 will be sent using the same payment method used between these dates, if you’re eligible.

Your payment might come later, for example if you are awarded a qualifying benefit at a later date or you change the account your benefit or tax credits are paid into. You will still be paid the Cost of Living Payment automatically and do not need to contact DWP or HMRC.

If you have received a Cost of Living Payment, but later it is found that you were not eligible for it, you may have to pay it back.

DWP and HMRC are using a computer program to identify those eligible to receive a Cost of Living Payment. If you are not content with this you can contact the office that pays your benefit or tax credits to discuss it.

Report a missing Cost of Living Payment for a low income benefit

If you think you should have had the £326 payment, but you cannot see it in your bank, building society or credit union account, you can report a missing Cost of Living Payment.

If you get tax credits, you will not get your first Cost of Living Payment until September 2022.

If you have already reported a missing payment, you do not need report it again. The DWP will reply to you as soon as they can.

You may get a lump sum payment of £150 if you’re getting any of the following:

- Attendance Allowance

- Constant Attendance Allowance

- Disability Living Allowance for adults

- Disability Living Allowance for children

- Personal Independence Payment

- Adult Disability Payment (in Scotland)

- Child Disability Payment (in Scotland)

- Armed Forces Independence Payment

- War Pension Mobility Supplement

Eligibility

You must have received a payment (or later receive a payment) of one of these qualifying benefits for 25 May 2022 to get the payment.

If you get a qualifying disability benefit from the Ministry of Defence (MOD) and a qualifying disability benefit from DWP, you will get a Disability Cost of Living Payment from DWP only.

If you receive a Disability Cost of Living Payment, but the DWP later finds that you were not eligible for it, you may have to pay it back.

When you’ll get paid

You’ll get the payment from September 2022. Payments will be made to people who get a qualifying disability from DWP before payments to people who get a qualifying benefit from the Ministry of Defence

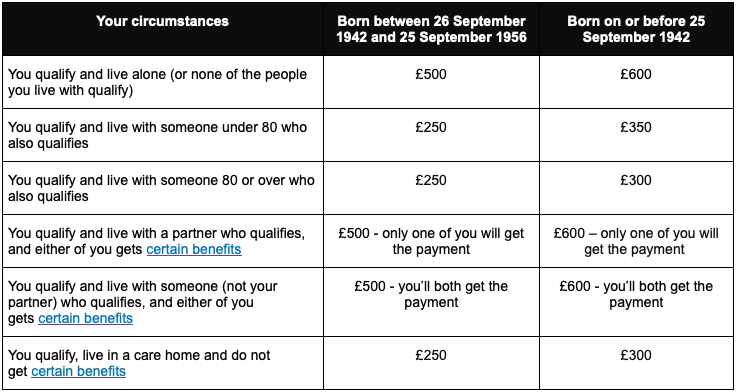

Pensioner Cost of Living Payment

If you’re entitled to a Winter Fuel Payment for winter 2022 to 2023, you will get an extra £300 for your household paid with your normal payment from November 2022. This is in addition to any Cost of Living Payment you get with your benefit or tax credits.

The full amount of Winter Fuel Payment you will get for winter 2022 to 2023 depends on your circumstances. These amounts are for winter 2022 to 2023 only.

Find out what other benefits and financial support you might be able to get to help with your living costs.

Use an independent benefits calculator to find out what benefits you could get.

You may be able to get other kinds of support, including:

- help from the Household Support Fund from your local council in England

- the Discretionary Assistance Fund in Wales

For further information for help with Cost of living visit Department for Work and Pensions